The Most Common PI Profile for Chief Financial Officers

A Chief Financial Officer (CFO) is the financial backbone of any organization. They oversee the company’s financial health by managing financial planning, risk management, record-keeping, and financial reporting. CFOs are crucial for strategic planning, ensuring that the company’s financial strategies align with its long-term goals. Without a CFO, a company risks mismanaging its finances, missing growth opportunities, and failing to meet its financial obligations, all of which can jeopardize its future. It’s no joke, the bottom line matters.

But, with 8 out of 10 CFOs saying their roles have grown significantly over the last five years, you need a better method to select the right CFO for your organization. Let’s dive into how the Predictive Index (PI) reference profiles can help you find someone who’s more than just good with numbers.

What is the “right” CFO for your organization?

Your company’s business cycle and complexity are huge factors. Think about investor relations, public company reporting, compliance, organization size, and where you’re at in your organization’s growth cycle. Each of these elements will require a specific skill or strength to get the job done. When you assess natural strengths and motivating needs using the Predictive Index Behavioral Assessment, you’re getting a solid data point on what makes someone successful in a CFO role.

So, what’s the best PI Reference Profile for a CFO? It really depends on what your organization needs. Here’s a quick rundown of what most companies look for:

- Cost Management and Financial Performance: Keeping an eye on the dollars and cents, and preparing financial reports.

- Risk Management: Planning for those “what if” moments, like economic downturns.

- Growth Architects: Managing investor expectations, and analyzing the ROI of organic vs. acquisitive growth opportunities

- Budget Stewards: Overseeing organizational budgeting and spending.

Questions to Help Identify Your CFO Needs

Ask yourself these questions to figure out the type of CFO you need:

- Do they need to communicate to the public or handle investor relations?

- Are they leading a turnaround or driving rapid growth?

- Will they tackle new responsibilities like ESG matters, mergers and acquisitions, or corporate strategy?

- Who else is in the C-suite or on their team?

Once you’ve created the picture of your ideal CFO, create a Predictive Index Job Target to hone in on the exact behaviors you’re looking for in the role. Then, it’s time to apply Predictive Index insights to match strengths that will best fit your needs.

The Best PI Profile for CFOs

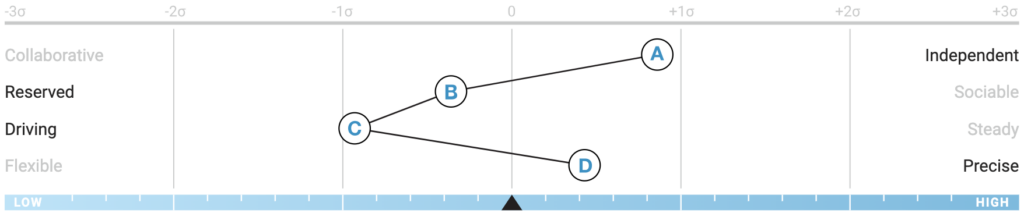

The Strategist: Innovative and Results-Oriented

The Strategist reference profile has a strong drive for change and is task-oriented, careful with rules and structure. As a CFO, the Strategist is all about achieving challenges and getting results. This profile is a good match for the complex, capital-intense organizations where the work is focused on qualitative elements of finance. A Strategist CFO will excel at corporate turnarounds when you need to drive results and get things done. This profile will bring a strategic, data-driven approach to building teams and communicate in a direct and factual manner.

Qualities of a Strategist:

- Good at both strategy and execution

- Big-picture focus with a future-oriented mindset

- Analytical, Task-oriented and independent

- Proactive and intense, with a good grip on organization and details

- Comfortable with some ambiguity and risk

Balancing a Strategist

While a Strategist will bring the facts and data, they will likely need to enhance their communication and interpersonal skills for the sake of their team. Most Strategists benefit from some up-skilling and “political smoothing” in their communication style (yes, we do mean you can’t “just say it like it is”, let’s soften a little). Strategist CFOs will also seek control of results by getting involved in specific details and processes. Some self-awareness to delegate and empower their financial team to make low-risk decisions will increase speed and success rates.

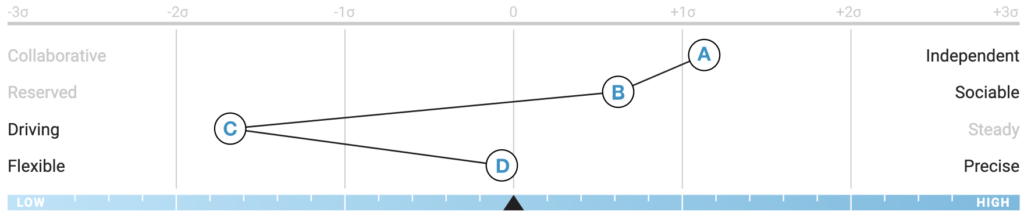

The Captain: Driving and Flexible

The Captain reference profile is characterized by high dominance, high extraversion, fast-paced action, and enough attention to detail to keep risk low. As a CFO, a Captain’s end game is accelerated performance and growth. This profile is a good match for larger organizations where work is complex and there is a large team of analytical, detail-oriented members who will bring balance and structure to the financial team. This CFO role may also oversee other support functions (HR, Payroll, IT). A Captain CFO will also excel when the role requires someone with higher extraversion for external or internal communication.

The best Captain profile for a CFO role would need only moderately high extraversion and no less than average to slightly low formality.

Qualities of a Captain

- Strategic planner

- Able to lead a large, complex finance and accounting function

- Decisive, with a “decide-and-announce” leadership style

- Strong at delegating details and will follow up

- Excellent at building relationships and networks

- Comfortable with ambiguity and working with a lack of structure

- Proactive in getting outcomes

Balancing a Captain

To be most successful, a Captain CFO needs to bring some self-awareness to the game and avoid pushing for change too quickly. A balanced team will include more formal, detail-oriented analysts who will raise questions and help alert of potential errors and roadblocks. The Captain profile’s fast-paced nature may breeze by the “what-if” future-casting too quickly. With that, a Captain may appear too authoritative and should adapt their communication style to listen more and respond to questions, inquiries, and raised hands on their team.

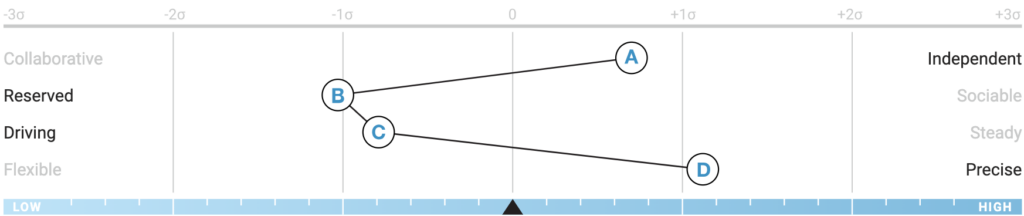

The Analyzer Profile: Disciplined and Focused

The Analyzer reference profile is known for being intense, reserved, and precise. As a CFO, an Analyzer will have a bigger focus on solving problems and reducing risk. This profile is a good fit for smaller, centralized, or stand-alone organizations who are in the state of systematizing finance functions. An Analyzer thrives in an environment where they can be more heads-down and solve problems with their hands-on, data-driven approach.

Qualities of an Analyzer

- Careful with risk

- Disciplined and detailed-oriented

- Good at juggling multiple activities

- Has a feel for the big picture, but focuses on details

- Excels at structure and process implementation

Balancing an Analyzer

To be most effective, an Analyzer will need to adapt their communication skills (just because most of the work is data and numbers, doesn’t mean there will be zero human interaction). The C-suite is full of decision-making. In order to move quickly, an Analyzer CFO will need to create a process that will allow them to take action without complete information. Lastly, an Analyzer will be most successful when they put an effort towards reducing perfectionism and encouraging compliance, without stifling innovation.

The Power of Self-Awareness in Financial Leadership

Self-awareness is a game-changer for financial leaders. Understanding Predictive Index offers insights into intrinsic strengths and areas for growth. Using a strength-based, scientific work style assessment empowers CFOs and the C-Suite to:

- Leverage natural abilities

- Identify areas for skill enhancement

- Build well-rounded teams for diverse thinking and better results

Aligning career paths with roles within the organization leads to improved team dynamics, higher job satisfaction, adaptability, and reduced turnover.

When Financial Performance Plateaus

What if your CFO needs to adjust? What if you are the CFO and don’t see yourself in these common profiles? That’s where MindWire comes in. Help CFOs understand their strengths, assess their team’s strengths, and drive performance growth through coaching, delegating, and leading by example.

Find your PI Behavioral Profile here.

Before you make a move or hire a new CFO, consider what job needs to be done, who else is on the team, and what strengths and motivating needs will make for the best CFO for your business. Don’t settle for average. With the Predictive Index Job Target software, you can find the right fit and watch your company soar to new financial heights.

Transform Your Business

Let’s get the right people in the right seats, using data and science, not horoscopes.